READ MORE | Money transfers in the Netherlands: the easy (and cheap!) guideĭutch people typically don’t like credit cards in general because the Dutch are very debt-adverse people. Even if you have a Visa Debit card or a Debit Mastercard, it doesn’t matter - Dutch stores will treat it as a credit card and may decline it. Why don’t your bank cards work in the Netherlands when they’re debit cards? Sorry, that’s tough luck.

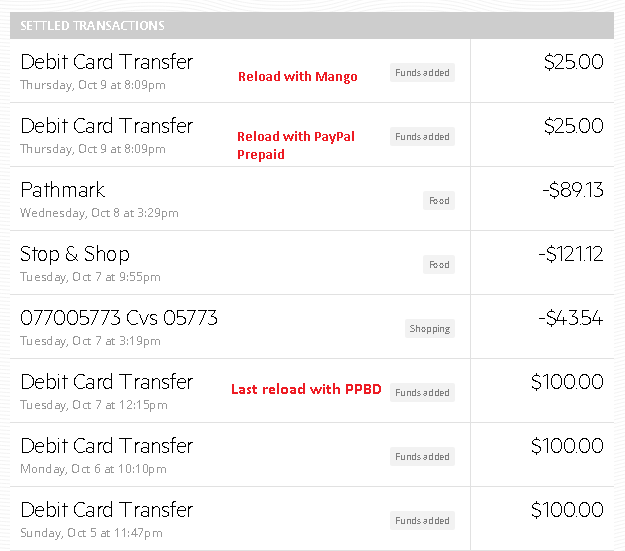

What does that mean for you? Well, it doesn’t bode well if you don’t have a Maestro card in the Netherlands. This is why credit transactions typically show as “pending” and offer an “available” and “current” balance.

READ MORE | Banking in the Netherlands: the complete guideĪ few days later, the merchant will present these “promises” to the bank, and collect their dues. However, most other payment platforms now rely on dual-message debit and credit cards, where when you swipe your card, your bank makes a “promise” to the merchant that the money will be there. Maestro cards work on a single-message debit system, where when you swipe your card, the money moves from your bank account to the merchant. The way different cards talk to credit card machines and the corresponding banks is also a point of trouble. Don’t have a Maestro card? Note that it is most likely needed in the Netherlands! Image: Freepik Communication breakdown

0 kommentar(er)

0 kommentar(er)